Add all of your debit and credit cards to the Curve app.

#Free budgeting software 2020 free#

Your free Curve MasterCard will be sent to you.Curve will take care of refunding the amount to your card and recharging it to the account you select. One great feature of Curve is that you can re-charge a transaction to one of your other accounts up to 14 days later for free, within the Curve app, if you accidentally pay for something with the wrong bank account or credit card.

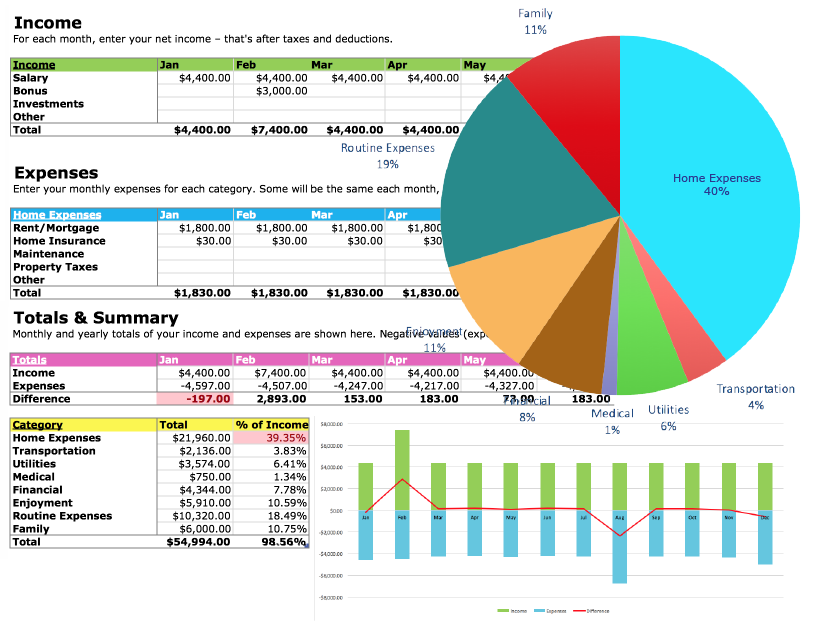

The Curve app shows you how much you have been spending with each of your accounts with its inbuilt budgeting tools, and breaks this down further by showing how much you have been spending on certain things, such as on groceries or at restaurants. With Curve, you use just the one Curve debit card to spend in-store and online with all of your accounts. Use just the one Curve card to spend with all of your debit and credit cards.Ĭurve sits somewhere between being a bank and being a budget app because it does a little bit of both.

Securely add all your debit and credit cards to your Curve Card app and use any of your bank accounts with just one Curve Mastercard. The App Store and Google Play store provides the vast majority of these apps where you can also view the latest updates and customer reviews. There is a wide selection of free budgeting apps available that can be downloaded to your mobile phone or used from your computer. Some apps go a bit further by giving you guidance on what action to take to ensure your money lasts until your next payday, or help you put money to one side to save or repay some old debts. The good thing about budgeting apps is that rather than having to check each of your individual banking apps to check your balance or see how much money you have left across all of your accounts, you can simply open your budget app and get a quick snapshot of how much money you have left and how this breaks down into weekly or daily budgets. Essentially, it plonks your bank, and the security that comes with it, in the middle of you and the app you want to use. With Open Banking, when you need to connect your bank to an app, you log in directly with your bank, and it then provides the app you wish to use with read-only access to your account. As you can imagine, this put many people at risk of fraud and it also didn’t give people much confidence or trust in using a third-party app to help them budget. What is Open Banking?Previously, if an app or third party needed access to your bank information, you would need to provide it with your online banking details. Many budgeting apps work by connecting to your existing bank accounts, credit cards, and savings accounts through Open Banking to give you an overview of your spending across all of your accounts.

0 kommentar(er)

0 kommentar(er)